MSME Helpline app for iPhone and iPad

Developer: Anshu Mohan

First release : 05 Nov 2015

App size: 1.54 Mb

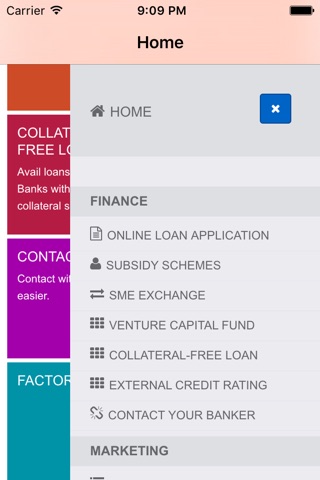

MSMEhelpline will be a tool in the hands of all the MSMEs in India to be able to find the solutions of most of the challenges faced by this sector. Some of the features of MSMEhelpline will be as under:-

Details of all Banks/ FI at one place with the contact details and various schemes by them for MSMEs,

Online Application forms for applying the loan proposals with various banks/ FIs,

Details of various Subsidies available to MSMEs,

Details of various Venture Capital Funds,

Details about SME Exchange,

Details of Collateral Free Loans,

Details about External Credit Ratings,

All schemes of Ministry of MSME and other Government departments for the benefit of MSMEs,

Important Circulars of Reserve Bank of India for Priority Sector Lending,

Details about the Public Procurement Policy,

Solution for Delayed Payments,

Procedure for Online EM registration for MSMEs,

Listing for MSMEs will be provided with details of their Location, Product, Website, Contact Details etc,

Latest News & Articles related to the benefit of MSMEs,

Details of All Lead Banks in India at all District level,

Details of all DIC offices in India,

Basic consultancy will be provided to the members of MSMEHelpline to best of our panel consultant’s skill, free of cost,

Grievance Cell will be available to the Entrepreneurs for fast Redressal of their problems